On the surface, everything was hunky-dory in the summer of 1929. The total wealth of the United States had almost doubled during the Roaring Twenties, fueled, in part, by stock market speculation eagerly undertaken by a wide swath of citizens ranging from Fifth Avenue dowagers to factory workers. One Midwestern woman, a farmer, made an overnight profit of $2,000 ($31,000 in today’s dollars) betting on a car manufacturer’s stock.

When the bubble burst in spectacular fashion in October 1929, many economists, including John Kenneth Galbraith, author of The Great Crash 1929, blamed the worldwide, decade-long Great Depression that followed on all those reckless speculators. Most saw the banks as victims, not culprits.

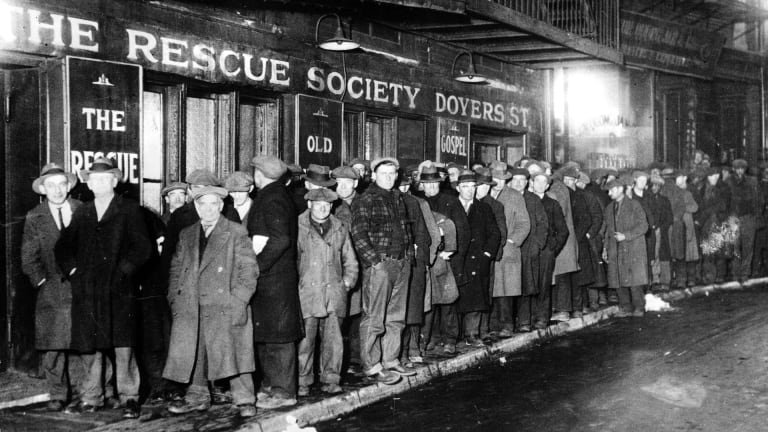

The reality is more complex. Sure, without all that uncontrolled and irrational market speculation, the 1930s might be recalled simply as a period when the economy and prosperity stalled. But just why—and how—could those gamblers dominate the stock market? And why did a crisis in the markets become a systemic decade-long economic catastrophe during which unemployment skyrocketed to 25 percent and the cost of goods and services plunged? By 1933, dozen eggs cost only 13 cents, down from 50 cents in 1929. Banks failed—between a third and half of all U.S. financial institutions collapsed, wiping out the lifetime savings of millions of Americans.

The familiar narrative of the Great Depression places banks among the institutions that suffered fallout from the crisis. In fact, in the eyes of such luminaries as Ben Bernanke, an economic historian and former head of the Federal Reserve, the crisis was all about the banks—from the central bank (the Fed itself), down to the smallest savings institutions. “Regarding the Great Depression…we did it,” Bernanke said in a 2002 speech, referring primarily to the Fed’s role. “We’re sorry.”

Here are four ways banks “did it”:

Banks Extended Too Much Credit

The runaway speculation that triggered the 1929 crash and the Great Depression that followed couldn’t have taken place without the banks, which fueled the 1920s credit boom. New businesses—making new products like automobiles, radios and refrigerators—borrowed to support non-stop expansion in output. They kept borrowing and spending even as business inventories soared (300 percent between 1928 and 1929 alone) and Americans’ wages stagnated. The banks, ignoring the warnings signs, kept subsidizing them.

The banks also funded the speculation itself, providing the money that individual investors needed to buy stocks on margin. That Midwestern farmer might have borrowed up to 90 percent of the money she needed to make her overnight killing on the automobile stock, financed by her local bank. Bank lenders discounted or downplayed growing signs that Americans were overstretched. Farm incomes, in particular, plunged in the years leading up to 1929, and others found their wages stagnant. Their prosperity came solely from their stock market wealth—which didn’t last.

The Informant

MORE ABOUT HISTORY CONTENT FOR YOUR STUDIES

Leave a comment